Stocks on Steroids: What You Need to Know about Leveraged Funds

You can now buy a 4X leveraged S&P 500 ETF. But should you?

Here’s a headline that instantly grabbed my attention:

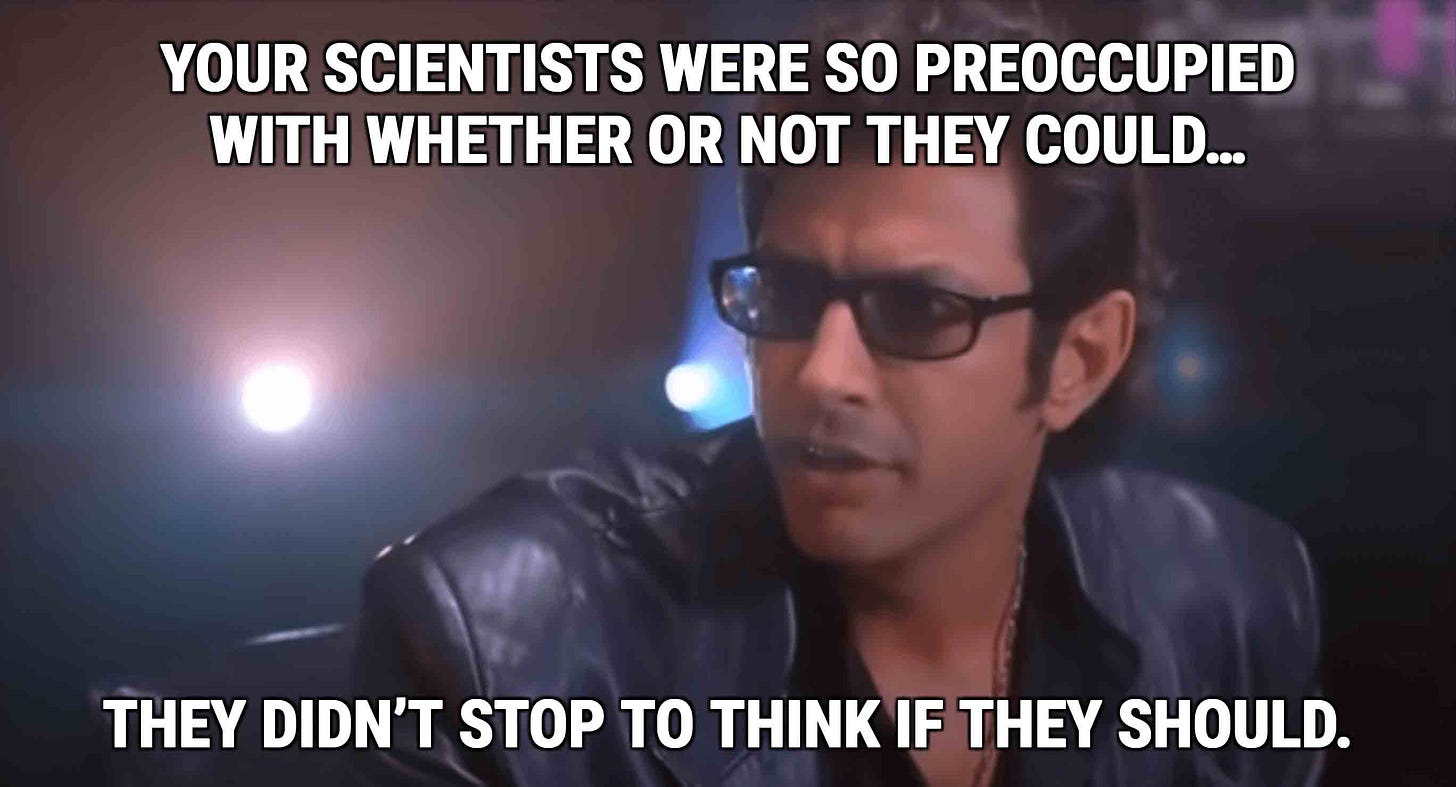

It can’t be denied that receiving 4 times the return of the S&P 500 is a pretty damn appealing sales pitch. But, as always, the devil is in the details.

In this article, I’ll explain how leveraged investment funds work and the extreme upside and downside that come with them.

What are leveraged ETFs?

Let’s start with the basic concepts of leveraged ETFs.

Leveraged ETFs are designed to amplify the daily returns of an underlying index. For instance, a 4x (or quadruple) leveraged ETF aims to deliver three times the daily percentage change of its target index.

Take, for example, an S&P 500 4x leverage ETF; if the index goes up by 1%, the leveraged ETF aims to go up by 4%—and vice versa.

How do leveraged ETFs accomplish this?

Leveraged ETFs use financial derivatives (like futures and swaps) and borrowing to achieve their leverage. They enter into these financial contracts daily to adjust their exposure to the index, aligning their performance with the desired multiple.

A key aspect of leveraged ETFs is daily rebalancing, which can lead to 'beta slippage' or the 'constant leverage trap.' Because these ETFs rebalance every day to maintain their level of leverage, their performance can start to stray from the intended goal, especially when the market is very up and down.

This slippage can lead to long-term performance issues.

These ETFs are designed to meet their leverage targets on a daily basis, but over longer periods, their performance can be quite unpredictable and may deviate from the underlying index.

Leveraged ETFs as a long-term investment

Given how new the 4X leveraged ETFs are, we don’t have much data on their long-term performance.

But, 3X leveraged ETFs have been around for nearly fifteen years.

A 2021 paper aptly named “Long-Term Investing in Triple Leveraged Exchange Traded Funds” investigates the performance of triple-leveraged ETFs over long periods.

The researchers wanted to understand how certain types of funds, designed to triple the gains or losses of a stock market index each day, actually performed from June 2009 to October 2020.

The leveraged ETFs in the study (3x the S&P500 and 3x the Nasdaq) had remarkable returns over that period with a compound annual growth rate north of 50%.

Yes, you read that right.

That’s a ridiculously high return, but if your goal is to 3x the return of the Stock Market during one of the best 11-year runs in the stock market's history, you will end up with pretty ridiculous returns.

The volatility was just as ridiculous, with the largest single-day drawdown of 70%. Imagine investing for a decade straight, and in a single day, your portfolio goes down 70%.

Few people have the stomach for that level of volatility.

You also need to remember that the sample period in this study starts just after the market bottom from the financial crisis. If the holding period were measured from just before the dot com crash through to the bottom of the financial crisis, you’d be basically wiped out.

You should also remember that this study was done with 3x leveraged funds. If a 3x leveraged ETF can have a 70% drawdown in a single day, what would a 4x leveraged fund look like?

Volatility + liquidity is dangerous

Investing in any risky assets comes with volatility.

However, investing in the stock market has volatility that is much more visible than investments like real estate and Private Equity. You can open your phone and see how the value of a leveraged ETF is changing by the second.

The visible volatility of the stock market wouldn’t be as big of a problem if it weren't so easy to sell off your entire portfolio with the click of a button.

The reality is you can sell off your entire portfolio with a click. So, if you open your phone and see your investment down 70%, you might have a moment of panic—and that moment of fear is all it takes to click “SELL” and turn paper losses into real losses.

I’ll leave you with this quote from Warren Buffett:

“I’ve seen more people fail because of liquor and leverage – leverage being borrowed money. You really don’t need leverage in this world much. If you’re smart, you’re going to make a lot of money without borrowing.”

This article is for informational purposes only. It should not be considered Financial or Legal Advice. Not all information will be accurate. Consult a financial professional before making any significant financial decisions.

Jeez, Ben, 70% a day sounds like a self-delivered death penalty. My finance teacher mentioned 3x ETFs in the context of professional traders. They use them as a hedge. Retail public should stay the hell away from them.