Your Brain Is Secretly Sabotaging Your Financial Plan

A new series from Making of a Millionaire addressing cognitive bias and money decisions

One of the best pieces of financial advice comes from a surfer who once said:

“Make sure your worst enemy is not living between your own two ears.”

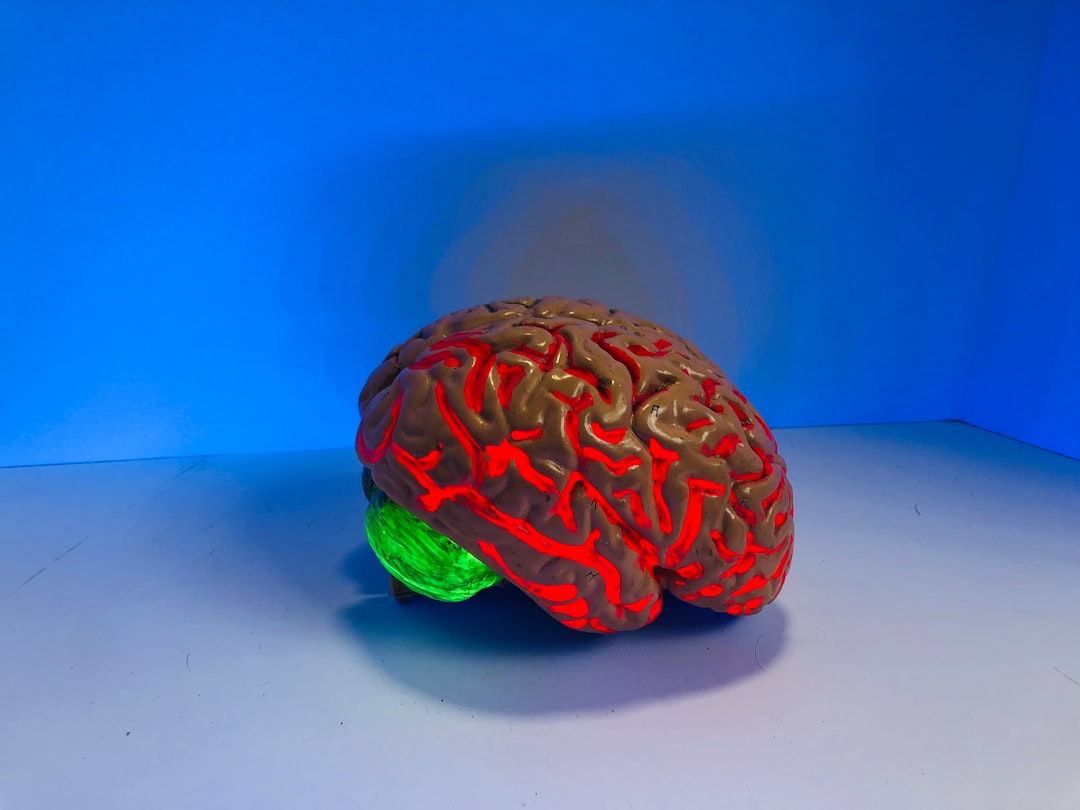

When Laird Hamilton said that, he was referring to the need to manage fear and decision-making while riding a big wave. But, when it comes to money, most people’s worst enemy is not their job, their terrible boss, or a bear market; it’s that three-pound ball of soft tissue resting between your ears.

Whether it be investing, salary negotiations, or contemplating making a significant financial decision like early retirement or quitting a 9-5 to start your own business, your worst enemy when making these life-altering choices lives between your own two ears.

That is why I am bouncing with joy to announce the launch of a new ongoing series, tentatively titled “Money On My Mind.” A collection of articles, courses, books, videos, and other resources to help my readers identify the cognitive biases, strategies to overcome them, and simple tricks and exercises that can be done in a few minutes per day to develop a more healthy money mindset.

We will dive deep into academic research and real-life examples and, of course, address reader questions and incorporate your questions and concerns into the series.

How long will this series last?

The short answer is, I don’t know!

Here’s the long answer:

This is an enormous topic that, to this point, I have largely ignored in my writing, focusing instead on the technical knowledge and facts about complex issues like investing—which, to be clear, are super important and I will continue to cover.

Knowing what to do with money is one thing, actually doing it day-in and day-out for an entire lifetime—including the really bad days where your mind is overloaded with stress—is a whole other ball game.

There’s so much to explore in this area, so it will take as long as it takes.

As always, I will try my best to keep as much of this material as possible free. But, the only way to access 100% of this series on the psychological aspect of managing money is to become a paid subscriber.

Becoming a paid subscriber supports this publication, gets you access to exclusive subscriber-only articles, and gets you free copies of my books “The Financial Freedom Equation” and “The Rational Investor.”

I’ve done my best to keep the cost of a subscription as low as possible (the annual plan is about $4/month), but if you are going through a rough patch right now and can’t swing a membership, send me an email, and I’ll comp your first year.

Stay tuned for the first edition of “Money On My Mind” in your inbox soon. In the meantime, I’d love to hear from you.

Leave a comment and let me know what you are most excited to learn in this series and what parts of managing money you are struggling with the most right now.

Cheers,

Ben

Looking forward to some great learning

Looking forward to the new series. Congrats!