My wife and I recently set up an investment account to help save for the cost of our son’s education.

I invest the money on his behalf because he is two years old, and toddlers have no business investing in the stock market.

Unfortunately, a lot of DIY investors act like toddlers.

They can’t sit still

Only focus on what is directly in front of them

They change their minds every five seconds.

They freak out when things don’t appear to be going their way

My toddler will scream bloody murder for an apple, only to take one bite, throw it away, and start crying for cookies. (Yes, I have eaten my fair share of half-eaten apples off the floor.)

Toddler investors jump into the stock market, thinking it’s an easy way to make quick money, only to jump ship when the water gets a little bit choppy.

If you want to be a great investor, you need to learn to sit still and do nothing. You need to learn to invest like an adult.

A stock market secret the financial media won’t tell you

The financial media acts as a sort of cheerleader for the stock market. Which is a very useful and necessary service. Most people find the stock market intimidating, scary, or even corrupt. When the average person thinks about the stock market, images of the financial crisis or some shady backroom dealings float through their mind.

This is a shame because the stock market — if used like an adult — is the best way for middle-class workers to build wealth.

Here’s the secret the financial media won’t tell you about the stock market.

The stock market is one of the worst places to put your money unless you keep it there for decades.

Stocks are a terrible short-term investment but an incredible long-term investment.

Stocks make for a lousy short-term investment because they are incredibly volatile (large swings up and down.) There have been single years (1931) when the S&P 500 lost more than 43% of its value and single days (1987) when the S&P 500 lost more than 22% of its value.

Lousy isn’t even the right word. Dangerous is a better word for it.

If I invest $10,000 in the stock market to pay for the future cost of my child’s education, there is a very real possibility that the investment could be worth $5,000 a year from now. If that happens, I’m not worried because my son is only three. If that happened when he was 17, that could mean he would be forced to do what I did—load up on student debt.

If you need access to your money in days, weeks, months, or even years from now, the stock market is a dangerous place to keep your money. Don’t get greedy with the money you’ll need to spend in the near future.

Grown-up investors think in decades, not years

Here is my favorite Warren Buffett quote:

“The first rule of an investment is don’t lose money. And the second rule of an investment is don’t forget the first rule. And that’s all the rules there are.”

Grown-up investors take Buffett’s golden rule of investing to heart. If you follow the data, there is a tried and true investing philosophy that ensures you follow Buffett’s rules for investing: Buy index funds and hold onto them for 20+ years.

No investor in history has ever lost money when they buy an S&P 500 index fund and sit on it for 20 years. That’s not hyperbole; it’s a fact.

The S&P 500 had had negative returns in 31% of years from 1872 to 2019. Nearly one in three years, the stock market provides negative returns. But that should only scare toddler investors.

Zoom out, and everything comes into focus.

Grown-up investors who hold the S&P 500 for 20 years and reinvest the dividends have never lost money between 1872 and 2019—And yes, that includes inflation.

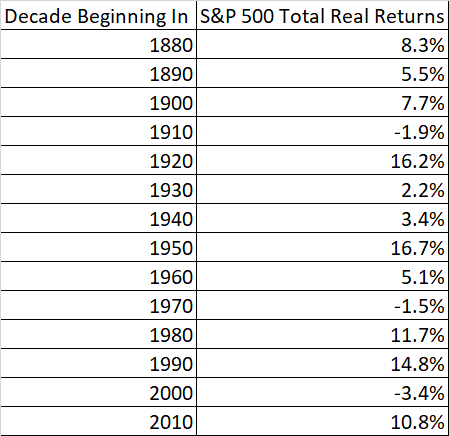

Here’s a chart that shows the total real returns of the S&P 500 for each decade from 1880 to the 2010s.

As you will notice, there are only three decades (1910,1970 & 2000) in which the S&P 500 had real negative returns.

This tells us two things.

Buying and holding index funds is as good a strategy to outpace inflation as you will find.

Investors who buy and hold for 20 years or longer get rewarded.

But most investors, even index investors, fail to sit still that long.

They get nervous about market crashes, so they sell — Right before the market unexpectedly takes off and has some of its biggest gains.

They get bored and sell their index funds in exchange for the hot new investment idea trending on social media — Just before the trending investment is about to blow up.

They get greedy and use dangerous tools like leverage to magnify their gains — But it ends up blowing up in their face.

So, if you want to be a great investor, invest like an adult; think in terms of decades, not years.

Let’s end with my second favorite Warren Buffett quote:

“Over the long term, the stock market news will be good.

In the 20th century, the United States endured two world wars and other traumatic and expensive military conflicts; the Depression; a dozen or so recessions and financial panics; oil shocks; a fly epidemic; and the resignation of a disgraced president.

Yet the Dow rose from 66 to 11,497.”

This article is for informational purposes only. It should not be considered Financial or Legal Advice. Not all information will be accurate. Consult a financial professional before making any major financial decisions.

To be good investors, we should read psychology books, not finance books.

I love these bits!

Such important data!

~~~

> The stock market is one of the worst places to put your money unless you keep it there for decades.

> Lousy isn’t even the right word. Dangerous is a better word for it.

> No investor in history has ever lost money when they buy an S&P 500 index fund and sit on it for 20 years. That’s not hyperbole; it’s a fact.

The S&P 500 had had negative returns in 31% of years from 1872 to 2019. Nearly one in three years, the stock market provides negative returns. But that should only scare toddler investors.

Zoom out, and everything comes into focus.

Grown-up investors who hold the S&P 500 for 20 years and reinvest the dividends have never lost money between 1872 and 2019—And yes, that includes inflation.