Retirement Redefined: How Working in Your Golden Years Can Keep You Happy, Healthy, and Wealthy

Challenging traditional retirement beliefs

Retirement is a confusing and scary idea to contemplate.

The idea of leaving the workforce and relying on savings can be stressful, even for those who have carefully planned for their golden years. Many people are behind on their retirement savings, and as they approach traditional retirement ages fear what the future hold for them.

The easiest solution is both obvious and possibly a little terrifying; work in retirement.

Most people underestimate the power that working in retirement—even a few hours per week—has on the sustainability of a retirement plan. The longer you work, the less you need to worry about outliving your money.

Every dollar you earn from working in old age is one less dollar you need to withdraw from your savings. Here’s a very messy & oversimplified example to illustrate the idea.

If you want to spend $60,000 every year in retirement and you have an impressive $1,000,000 retirement nest egg, using the 4% rule, you’d only be able to fund $40,000, which puts you at serious risk of outliving your money. Working part-time and earning $30,000 per year—even if only for a few years— dramatically increases your odds of a successful retirement.

People are living longer, the cost of living continues to rise, and most people don’t save enough to fund the traditional definition of retirement. It’s time we become more flexible in what we call “Retirement” to include at least the possibility of continuing some form of paid work.

The problem is that many people cling to an antiquated (if it ever truly existed) idea of retirement, meaning you stop all paid work at a certain age, and if you don’t achieve that, you have somehow failed in life.

Continue reading to learn how your beliefs about aging can impact your motivation to continue working in retirement—and most importantly, you’ll learn how to adopt a positive mindset about aging, work, and retirement.

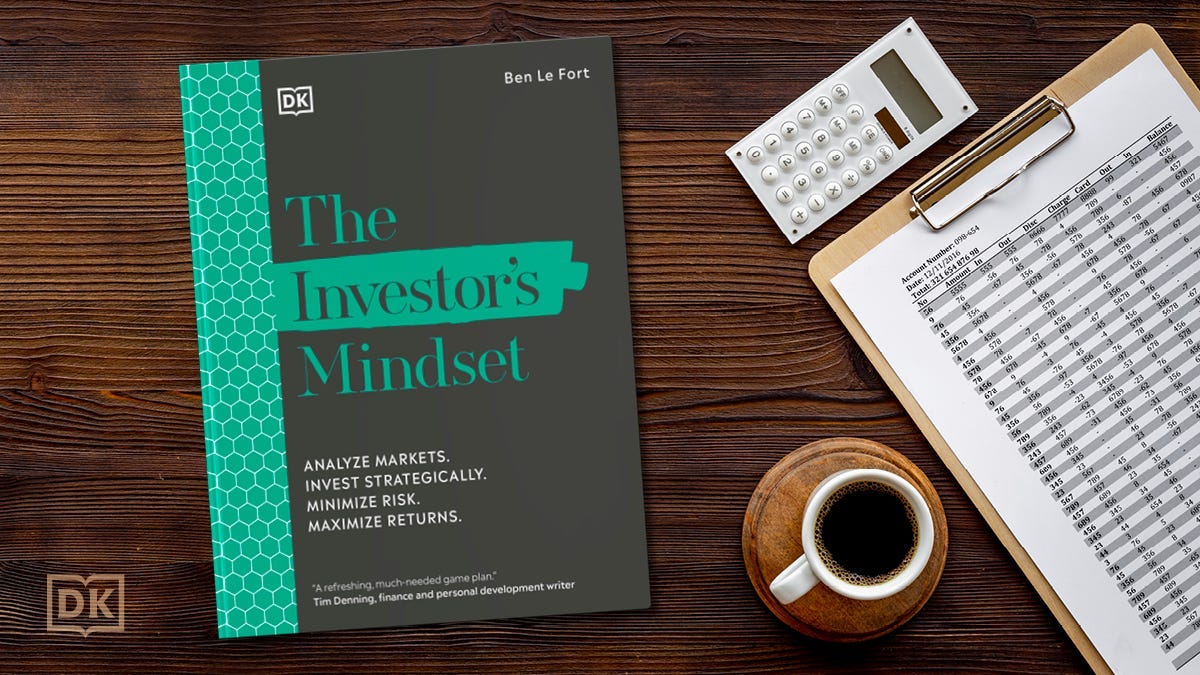

Pick up your copy of The Investor’s Mindset

My new book, The Investor’s Mindset, is your playbook to win as a long-term investor.

In part 1 of the book, I lay out a simple investing framework + give my best tips for managing money as an investor

In part 2, I teach you how to prevent fear and greed from destroying your plan.

Pre-order The Investor’s Mindset on Amazon or wherever you buy books.

Working in Retirement: The Impact of Aging-Related Beliefs on Motivation

A 2022 research paper finds evidence that our beliefs about aging could play a significant role in our motivation to continue working.

The study, conducted by a team of researchers from Germany, examines the impact of essentialist beliefs about aging on older workers' motivation to continue working beyond retirement age. The researchers define essentialist beliefs about aging as the belief that aging is a fixed and biologically predetermined process. These beliefs can limit our perception of whether we can continue working as we age. This leads to a decreased motivation to continue working beyond retirement age.

The researchers conducted two studies.

The first study looked at how different people think about aging, their future job plans, and their desire to keep working after retirement age. The study discovered that people who believe aging is a fixed trait are less likely to want to work after they retire because they think no company will want to hire them.

The second study confirmed the results of the first study. People who were told that aging was a fixed thing were less likely to want to work after retirement because they felt like they couldn't do as much. This was true no matter how old they were, what gender they were, how healthy they were, how educated they were, or what they thought about older people in general.

Careers and retirement are concepts we have invented. What it means to retire is not set in stone or a scientific fact. You can choose to think differently about aging by adopting a growth mindset. You can work to stay healthy and active both physically and mentally and engage with your work and communities to feel purposeful and fulfilled as you get older. These can help shape your beliefs about your prospects of continuing to work after retiring from full-time work.

Final thoughts

If you're worried about retiring, expand your definition of what it means to retire and what you’ll be capable of in old age. You can keep working if you stay motivated and engaged in your work and community. Employers can help by not thinking negatively about aging and by offering jobs to retirees. This is good for everyone because older employees have a lot of experience and knowledge to offer to younger workers.

Understanding how aging beliefs affect motivation can help you make better choices about your career and retirement plans.

If you want to learn more about redefining your mindset about working in retirement, I would recommend you check our

’s excellent newsletter.Get smarter with money

Consider becoming a paid subscriber and unlocking my full archive of posts.

Already a paid subscriber? (thank you!). Consider donating a paid subscription that I can give away to a reader who is going through a rough patch financially. Anyone who donates a subscription will receive a 50% lifetime discount on your subscription.

This article is for informational purposes only. It should not be considered Financial or Legal Advice. Not all information will be accurate. Consult a financial professional before making any major financial decisions.

Retirement to me simply means the freedom to experiment with other types of work without the need to make a full time income all the time. I crave the flexibility to work when and how I want to on topics I find highly interesting. That is retirement to me. They call it solopreneurship nowadays.

Thanks for the shout out, Ben. I appreciate it.