It’s times like these; I am reminded of the importance of this publication’s mission to cut through the noise, fear, and mania that is financial coverage on mainstream media and social media.

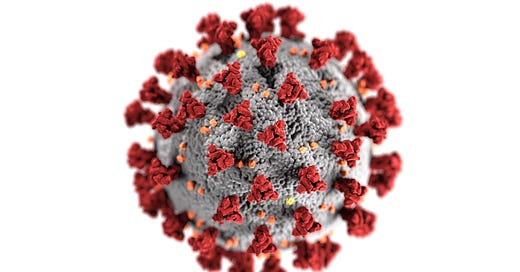

Last Friday, the WHO classified COVID variant B.1.1.529. or as it’s now known, “Omicron” as a variant of concern. While much is not yet known about Omicron, it appears to have significant mutations that have researchers worried about the transmissibility of this strain.

At this point, we don’t know much.

We don’t know what will happen with the trajectory of the pandemic and we don’t know how the stock market will respond.

But the labeling of Omicron as a variant of concern has investors spooked, and the S&P 500 dropped 2.25% in the market’s worst day since the early days of the pandemic.

Here’s what rational, long-term investors are doing in response to Omicron

Absolutely nothing.

This is exactly what I wrote in March 2020 during one of the most violent market crashes in history, where the S&P 500 lost 27% of its value in a matter of weeks and 12% in a single day.

Why?

Because if you are well diversified and invested for the long run, what happens in the markets today—No matter how scary those things might be— will have little to no impact on your portfolio decades down the line.

So, long as you don’t sell when markets are down and turn “paper losses” into “real losses”

Two groups of investors got royally screwed during the 08-09 financial crisis.

Recent retirees who were forced to withdraw from their decimated portfolios to buy groceries.

Young investors who panicked and sold when markets were down 40%.

During the 2020 market crash, it was just the investors who made panic-driven decisions to sell felt the pain.

Why?

Because as quickly as the market tanked, it came roaring back with even more vigor. I am writing this on Friday, Nov 26th (the day the S&P dropped 2.5%), and markets are up 100% (doubled) since the bottom of the 2020 COVID crash. In fact, the market is up 36% from its pre-COVID peaks.

Anyone glued to CNBC or Twitter during the early days of COVID was getting a healthy dose of fearful narratives about the destruction of the economy and the stock market.

How many times did you hear the phrase: “This time is different!”

We heard it during the first wave of COVID

We heard it during the financial crisis

We heard it during the tech bubble

We hear this time is different during every stock market crash. There is always a new (and in fairness legitimately scary) narrative as to why this time is different; that the market will go down and stay down.

Can you imagine what it would have been like if we had Twitter during the great depression?

What happens after a stock market crash?

Here’s a comforting dose of empirical evidence:

The cause of every stock market crash is different, but the result is always the same; markets recover, and investors who own the whole market and wait it out are rewarded.

I don’t know what’s going to happen over the weeks and months ahead with Omicron.

For all I know, we could have another market crash. If we do, you can be assured of two things:

Highly influential media and social media personalities will be spinning a very scary narrative about “Why this time really is different.” (my prediction for most common narratives if the market tanks: money printing and inflation will ruin the economy, and these same people will be pushing gold and Bitcoin.)

This time will not be different.

I’d encourage you to read this paper in The National Bureau Of Economic Research. The researchers studied stock market crashes from over 100 global stock markets from the years 1692–2015.

In this dataset, the researchers observed more than 1,000 “stock market crashes” where a market experienced at least a 50% decline in one year.

During these stock market crashes, they found two clear patterns.

Stock prices tended to increase dramatically following crashes

Investors reduced their allocation to stocks

During market crashes, a lot of investors sell-low because they were afraid of further losses. As a result, they missed out on large future gains. These are the investors who listen to the “experts” who were screaming that “this time is different.”

So, if things get rocky and you start hearing this time is different, remember; the cause is always different, but the story almost always ends the same way, with the market eventually rebounding.

One last thing

Periods of high volatility are a useful natural experiment to reveal your true risk tolerance.

If sudden drops in the market cause you to lose sleep, that’s a clear sign you can’t handle the level of risk you have in your portfolio. If that’s the case, it might be best to sit down with an advisor who can help you reallocate to a more appropriate portfolio once the dust settles.

Spread The Wealth

👉 If you have a friend that’s into personal finance, I would be grateful if you shared this post with them and encouraged them to join the community.

If this is your first time here and you enjoyed this post, click here to subscribe For free.

If you believe in our mission to build a new kind of financial media company, become a paying subscriber (personal finance tip: annual memberships are 58% cheaper)

Trending on MOAM

Post of the week on Medium: Your 6 step plan to win with money

This article is for informational and entertainment purposes only. It should not be considered Financial or Legal Advice. Not all information will be accurate. Consult a financial professional before making any major financial decisions.