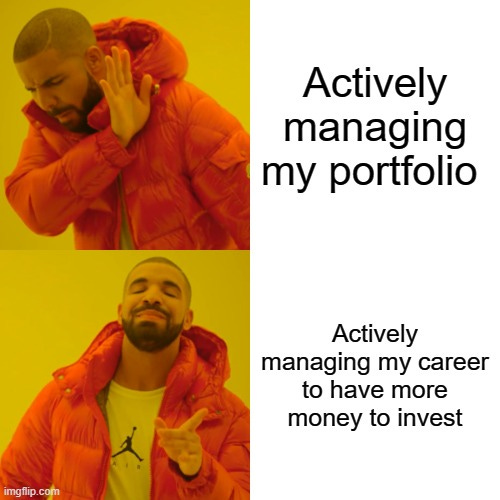

Focus on Your Savings Rate Not Your Investment Returns

Then focus on what you actually can control to boost returns

Get Free Access to the Paid version of Making of a Millionaire

The MOAM referral program has launched. Basically, you get a month free for every person you refer to read Making of a Millionaire.

Referring one person gets you instant access to my books, The Financial Freedom Equation and The Rational Investor.

If you can’t pay for a paid subscription to MOAM, referring a friend is a great way to help this publication grow and help more people.

Not subscribed yet? You can do so here:

In most areas of life, hard work pays off.

When it comes to investing, the opposite is true.

The harder you try to be a “good investor” and work hard at managing your portfolio, the worse your returns will likely be.

This lesson is one of the most difficult for investors to learn. Even (mostly) rational buy-and-hold index investors can get into trouble when they try and time the market or begin dabbling in picking individual stocks they think will outperform.

I am not here to tell you that investment returns don’t matter; of course, they matter.

You have no control over your investment returns—the harder you try and beat the market, the more likely you are to underperform.

If you want to build more wealth, focus on what you can control:

How much you invest

The fees and taxes you pay on your investments

How long you stay invested

Savings rate > investment returns

If, at the end of every month, you have extra cash that you could invest, congratulations, you’re winning with money!

Your savings rate—the percentage of your take-home pay that you save—is the best predictor of your future wealth.

You can’t control what happens in the stock market—but you can control how much money you invest.

There are two ways to increase your savings rate:

Reduce your spending.

Increase your income.

Reducing your spending comes down to the tried-and-true nuts and bolts of personal finance: Tracking your spending and finding expenses to cut, and creating a new budget.

Making more money requires you to either start a side hustle or focus on climbing the corporate ladder and increasing your 9-5 income.

You don’t have to eat beans and rice or grind 60+ hours a week to increase your savings rate. The easy path to a higher savings rate and more wealth, in the long run, is to treat new money like it does not exist.

This allows you to maintain your current lifestyle and workload and treat your annual raises, bonuses, and unexpected windfalls as money that can be saved.

If you get a 2% raise at work—automate that new income to savings/investing.

Got a year-end work bonus? Invest it.

Tax refund? Invest it.

Inheritance from your rich uncle? Invest it.

Maintain your current lifestyle and invest new money—or, as I call it, “reverse lifestyle inflation.”