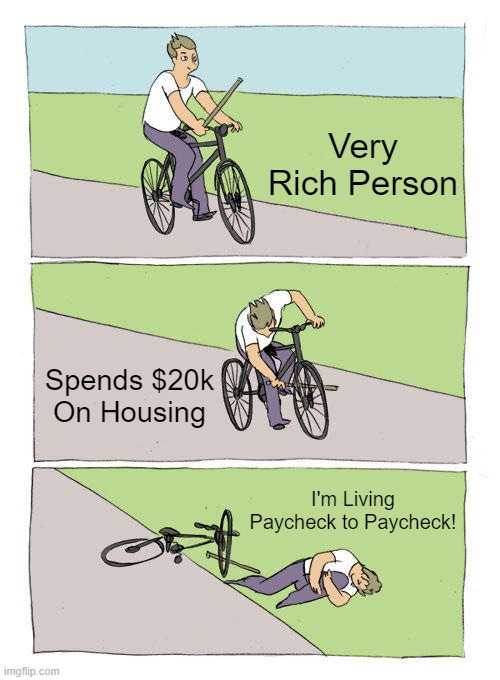

$20,000/Month on Housing But Living 'Paycheck to Paycheck?'

People Actually Living Paycheck to Paycheck Don't spend $2,000/Month on Travel

“What's the point of living a life like this?”

That is the sign-off on the latest viral post in my least favorite genre of personal finance content “Actually, it sucks to have money.”

Here’s the full post:

First, let’s think about what the term “living paycheck to paycheck” really means.

It’s a very squishy term, but generally speaking, it used to mean someone who was working full-time but could barely afford to put food on the table.

But, according to Twitter, living paycheck to paycheck can also mean:

Buying a $3 Million house

Having two cars

Sending your kid to a private school (!)

Spending $2,000 per month on travel (!!)

Spending $2,000 per month on groceries (!!!)

Spending $1,000 per month eating out (!!!!)

$21,000 per month on housing

$17,000 mortgage + $3,000 in property taxes + $1,000 perm month on utilities.

That is the first thing that will jump off the page—but in my opinion, it's not the most ridiculous thing on this list.

Spending $250,000 of after-tax income on housing costs is not a luxury that most reasonable people would consider a hallmark of people living paycheck to paycheck.

I scrolled down this thread on Twitter and found someone who raised this very point. The original poster stated that “that’s what it costs for a very average 3-bedroom home in San Fransisco.”

Look, I’m Canadian and have never been to San Fransisco. I'm not going to pretend to be an expert in the Bay Area real estate market.

But I do have Google and an internet connection, and within 10 seconds was able to find half a dozen 3-bedroom homes in San Fransisco that rented for about $5,000 per month:

So, I find it hard to believe that the only way to find a nice home for a family of three is to spend $21,000 per month.

(If is reading, I would love his thoughts on this housing issue in the comments ).

Also, $1,000 per month on utilities for a ‘very average’ home?

Again, a quick Google search shows that the average utility costs in San Fransisco come in at $300-400.

But if you live in San Francisco and spend $1,000 per month on utilities, please let me know in the comments—and please let me know if you would consider your home to be average in size.

$3,000 per month for private school

Again, I don’t know what the going rate for private schools is in the Bay Area.

But I can tell you that having $36,000 per year in net income to send your kids to private school is not a sentence you use to describe someone who is barely scraping by.

$2,000 per month on travel

I’ve also never met anyone living paycheck to paycheck who has room in their budget for $2,000 per month for travel. This also implies that not only do they have lots of disposable income, but they also have enough time available to go on what the budget indicates are very nice vacations.

I remind you this Twitter thread ends with the question, “What's the point of living a life like this?”

$1,000 per person per month on food

$2,000 per month in groceries for a 2-adult, 1-child household?

Look, I love Sci-Fi movies, so I have a healthy willingness to suspend my disbelief in a story.

But, if you want me (and the internet) to feel bad for your financial situation, you can’t then tell me that you spend $1,000 per month eating out. Here’s a pretty basic personal finance lesson:

If you're feeling financially strained, the very first budget item on the chopping block should almost always be eating out.

Also, these people are parents, and they not only have the money—but the TIME to spend $1,000 per month eating out?

All the parents reading this, please let me know how many nights a week you eat out?

I also wonder how these people manage to spend $2,000 per month if they are spending that much eating out.

In Reality, these people are probably pretty wealthy

In a past article, I reviewed research that came up with a perfect term for people making nearly $1,000,000 but considered themselves living ‘paycheck to paycheck.’ They are called The Wealthy Hand-To-Mouth.

Living “paycheck to Paycheck” Looks Different for the Rich

I recently wrote about the dark side of storytelling.

This phrase describes people who are, in fact, quite wealthy but have very poor monthly cash flow.

These people tend to have lots of wealth stored in very illiquid assets like houses and retirement plans. If the people in this Twitter thread are making $700,000+ living in the Bay Area, I am going to go out on a limb and assume they almost certainly have either a healthy workplace retirement plan or somekind of stock options.

Should these people be compared in any way to someone making the median income and who is actually living ‘paycheck to paycheck?’

Of course not.

Travel

Multi-million-dollar home

Constantly eating out

Private school for the kids

Two brand new cars in the drive w

The Wealthy-Hand-To-Mouth enjoy a greater lifestyle than almost every person who has ever lived.

But yes, with a life like that, what’s the point of living?

This article is for informational purposes only. It should not be considered Financial or Legal Advice. Not all information will be accurate. Consult a financial professional before making any significant financial decisions.

Ben, I can almost hear your indignant tone haha :)

Their spending habits go against your top advice to minimize the biggest expenses, namely, mortgage payments, to have their spending under control.

Exactly. Even in San Francisco, $21,000 is insane.